My take on the latest developments in IT companies, IT and Software Engineering, Project Management experiences, reflections on PMBOK, critiques on Project Management books. Nerd Alert! :)

Thursday, December 26, 2013

Value Stream Mapping Current state map markup and Future state map for a call center

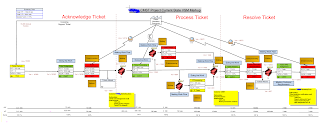

The next step in Value Stream Mapping is the Markup for the current state map. At this step, the bottleneck areas are identified in the current value stream map. As shown in the diagram below for the call center value stream map, a markup is created by identifying the bottlenecks at each step of the ticket resolution process. The type of bottleneck is also identified at this step such as Overprocessing, Defect, Waiting etc. These bottlnecks need to be removed and the process needs to be stream lined.

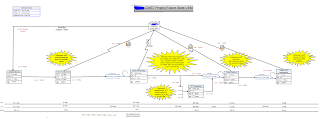

The last step in Value Stream Mapping is the Future State Mapping. In this step, the bottlenecks identified in the current state map markup are removed and the future streamlined process is documented as a diagram. The star bursts indicate the process improvements. The flow of the entity through the process is recorded. The volume of entities processed at each step of the process is also documented. Here is a sample future state diagram for a BPO call center that I created from a project that I worked on where "ticket" is the entity that passes through the process. The potential ticket volumes are recorder at each step. If you do not have the exact volumes, use a best guess estimate. The processing time and lead times are measured and calculated for each step. Click on the future state map image below to see full size image. This diagram was created using Microsoft Visio. Please leave any questions in the comments section below.

The last step in Value Stream Mapping is the Future State Mapping. In this step, the bottlenecks identified in the current state map markup are removed and the future streamlined process is documented as a diagram. The star bursts indicate the process improvements. The flow of the entity through the process is recorded. The volume of entities processed at each step of the process is also documented. Here is a sample future state diagram for a BPO call center that I created from a project that I worked on where "ticket" is the entity that passes through the process. The potential ticket volumes are recorder at each step. If you do not have the exact volumes, use a best guess estimate. The processing time and lead times are measured and calculated for each step. Click on the future state map image below to see full size image. This diagram was created using Microsoft Visio. Please leave any questions in the comments section below.

Monday, December 23, 2013

Capstone Project - Infosys China - Strategic Analysis

For my capstone project, I chose Infosys Technologies Limited, and did a strategic analysis of Infosys' decision to expand in China. The strategic analysis includes a background of Infosys Ltd, customer segments, geographic scope, timeline of the decision to expand in China, Macro-environment as well as Internal environment of the company in terms of its vision, mission, financial position and competitive advantage.

Executive Summary

Infosys Technologies Limited, is adopting an

aggressive expansion strategy in China, with a proposed investment of $125-150

million to set up its own state-of-the-art campus in Shanghai to build up

service delivery capabilities and serve the local market. Infosys has

traditionally been averse to acquisitions, held its premium pricing strategy

and focused on its core IT enabled services business. However, the recent

changes in the corporate leadership in 2011 and slowdown in growth, have

prompted a strategic shift towards global expansion and moving up the value

chain with consulting and technology partnership. The Chinese expansion

decision comes at a time when Infosys is making a strategic shift towards global

expansion through acquisitions and partnerships.

Infosys considers China as a potential market as

well as potential resource pool for the company's global aspirations. Increasing

competition with other multinationals for skilled IT professionals, soaring

salaries in India and an emerging Chinese market were the main reasons for

entering China as a low-cost center. However, China also presents significant

challenges in terms of economic slowdown, political/legal issues such as

government regulations and intellectual property protection, socio-cultural

issues such as high attrition rates and low availability of English-speaking

professionals, and increased domestic and international competition for labor

and clients.

Infosys must look to expand in China as it is an

important emerging market; most of its clients and other multinational

companies are also moving into China and Infosys should not lose this

opportunity. It should leverage its competitive advantage to attract employees

and support its growth, but also keep a close watch on the external environment

in China.

I.

Overview of the Business

A. Company

Background

Infosys is a global consulting and an Information

Technology (IT) Service Company, headquartered in Bangalore, India. It went

public in India in 1993 and got listed on the United States of America (USA)

NASDAQ in 1999. Infosys Limited was founded in 1981 by Narayana Murthy and six

other people. Murthy, who was the CEO from 1981 and became the Chairman in

2002, retired in 2011 upon turning 65, and is now the Chairman Emeritus at Infosys.

Infosys, most famously under the leadership of N.R. Narayana Murthy and Nandan

Nilekani, came to define an industry that symbolizes modern entrepreneurial

India, with legions of young workers converging on its Silicon Valley-style

campuses[1]. Co-founder and chief

operating officer S.D. Shibulal is the current CEO. Infosys has more than

153,000 employees. From a capital of US$ 250, Infosys has grown to become a US$

7.126 billion (LTM Q2 FY13 revenues) company with a market capitalization of

approximately US$ 28 billion.

B. Industry(s)

in which company competes

Infosys competes in

the Software and Information Technology Services and Consulting industry and

focuses on providing IT expertise, software design, development and maintenance

services as well as on-site management and other IT functions to its customers.

Driven by strong demand of IT infrastructure in developing economies, the

global information technology industry is expected to grow at a rate of 5.88%

during the period 2011-2015, according to a report by global research firm

TechNavio[2].

C. Customer

segments served

Infosys offers

business technology consulting, IT services and IT solutions in major

industries such as Aerospace & Defense, Airlines, Automotive, Communication

services, Energy, Financial services, Healthcare, High-tech, Hospitality and

leisure, Insurance, Life sciences, Logistics and distribution, Manufacturing, Media

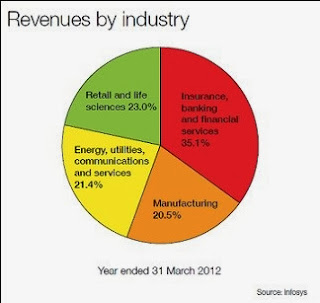

& entertainment, Public sector, Retail and Utilities Industry. As shown in

the following chart, the revenues are almost equally distributed across its

five major customer segments.

D. Products/services

offered

Infosys provides end-to-end IT solutions which

include software application development, testing and maintenance, business

process management, infrastructure management and product engineering services.

During the financial crisis, many companies cut down on IT costs. Infosys realized

that in order to have sustainable growth, the company needs to move up the

value chain and not simply be a low cost IT service provider.

Infosys has been shifting its strategy to increasingly

offer platform and product solutions, which are geared towards providing much

more value to its clients, getting more clients and delivering high value

product and services in a cost effective way. Some of the popular products from

Infosys are Finacle – Universal Banking Solution, Infosys Care Suite and

Infosys Real-time Expertise Manager – Customer service products, Infosys Supply

Chain Performance Management Suite, and SpeedSolve – Chat-based customer

support product. Infosys also offers a suite of business platforms called “Infosys

Edge”, that helps businesses simplify digital marketing, multi-channel

commerce, manage IT asset performance, increase

employee engagement and accelerate long term growth and profitability[3].

Following is a graphical representation of Infosys

revenue from product services offered in FY 2011. A bulk of the revenue is

based on application development and maintenance of existing applications for

its clients.

E. Geographic

scope of the business

The Infosys brand has moved out of India. Infosys

has a global footprint with offices and development centers in 77 cities spread

across 32 countries from Americas, Asia Pacific, Europe, Middle East and

Africa. A bulk of the revenue is generated from managing the back-office

computer systems of multinational companies in the US and Europe as shown in

the following chart[4].

The company continues to expand at a great pace and is scouting for

acquisitions in 'all geographies' to expand its overseas footprint.

F. Business

level strategy

The business model of Infosys is based on the Global

Delivery Model (GDM), which takes advantage of the company’s global presence in

delivering value to clients. Infosys pioneered the Global Delivery

Model (GDM), based on the principle of taking work to the location where

the best talent is available, where it makes the best economic sense, with the

least amount of acceptable risk. Continued leadership around GDM enables

Infosys to drive extraordinary efficiencies and free up clients’ resources for

strategic transformation or innovation initiatives[5]. This means not only is Infosys becoming

a global brand, but it also has the capability to support the global operations

of multinational clients.

The company’s global presence allows its clients

certain benefits which include the ability to work around the clock and

business continuity. For example, if the client has working hours from 9 to 5

in the USA, the next shift picks up in India after 5pm in America and works

when the USA office is closed. It also saves the customer from any disruption

to its business in the event of say a natural disaster, as the business

operations just get picked up by another location not affected by the disaster.

From the beginning, Infosys focused on

“differentiation” strategy through innovation and quality and positioned itself

as a premium IT service provider compared to its peers in the Indian IT

services industry. In line with this, it also enjoyed higher margins of 25-30%

as compared to its peers such as Wipro, TCS and Cognizant[6]. However,

compared to its other global competitors such as Accenture, Deloitte and IBM,

Infosys is a “low-cost” service provider.

II.

Description and Brief Discussion of the

Strategic Decision

A. Strategic

Decision

Recently, Infosys announced the expansion of its

offices in China. Infosys is planning on establishing its own development

center campus in Shanghai, Hangzhou and Beijing that can accommodate about 8000

employees, a sales office in Hong-Kong and a global education center in

Jiaxing, with a proposed investment of $125-150 million. Infosys BPO, the

business processing outsourcing arm of Infosys, is also setting up a new center

in Dalian, China, with a 500-person capacity[7].

Though most Indian software firms have face difficulties in the Communist

country, Infosys believes it’s all about perseverance and intends to hire 2,000

more employees, despite attrition rate climbing to an unusually high 20%[8].

In this paper, I will analyze Infosys’s strategic decision to expand operations

in China and examine the strengths and weaknesses of Infosys as an organization

as well as the opportunities and threats to Infosys as it pursues expansion in

China.

B. Time

line and Timing of the Decision

Infosys established its first BPO centre in China in

2006. The decision to expand operations in China was announced in the late 2011

after 5 years of operating in China. Construction for the new projects has

already begun. And when completed, the new centres will undertake projects in

software development, IT services and IT-enabled services, and will also act as

one of the training and research centres of the company. Infosys has big plans

for China and sees it as a potential market for it to grow in terms of new

clients and customers, and the low-cost high-skilled labor acts as a attractive

source for the company to expand and setup new development centers outside

India.

III.

External Environment (Opportunities and

Threats):

A. Macro-environmental

forces

1.

Economic

One of the reasons that encouraged Infosys to enter

China in the early 2000s was the rapid growth of the Chinese economy which had

attracted several multinationals, many of which were clients of Infosys. However

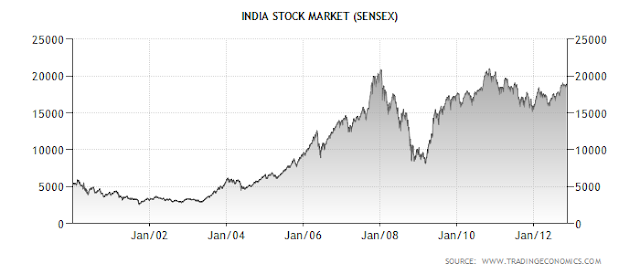

in recent years, there has been an economic slowdown in China; while India’s stock market has soared in

recent years, the opposite has happened in China.

China’s

GDP growth rate has also been declining in the last ten years. Infosys will

need to closely monitor the economic situation in China in the coming years.

2.

Political/Legal

The political

environment in China also presents a higher degree of difficulty in conducting

business as compared to India. India has a more laissez-faire attitude in both

politics and business. China, being a communist nation, has greater regulation

and involvement. Infosys had a first-hand experience of Chinese government

regulation concerning the ownership structure, repatriation of profits and the

shareholding pattern, when it first tried to establish a branch office and was

given permission to set up a joint venture with the government[9].

Infosys was against the joint venture as both parties would have conflicting

agendas; government with its political agenda of creating jobs and acquiring

knowledge, and Infosys with its agenda for maximizing profit. Infosys then

established a representative office and started working towards obtaining

permission to establish a development center. These issues had delayed Infosys'

Chinese venture but eventually Infosys set up Infosys Technologies (China) Co.

Limited as a wholly-owned subsidiary in 2003 and Infosys Technologies

(Shanghai) Co. Limited as a wholly-owned subsidiary in 2011.

The legal environment

in China also poses a risk for Infosys in terms of Intellectual Property

protection. Like India, the intellectual property laws are present, but not

strictly enforced which results in software piracy and copyright infringement

issues. When working with multinational clients in China such as banking,

financial services or insurance, Infosys will need to strictly enforce

governance standards to ensure intellectual property and sensitive data

protection.

3.

Sociocultural

Chinese programmers

tend to have limited English-language skills are better equipped to understand

and analyze material written in Chinese and to customize programs for the

Chinese market. Infosys will need to invest in language and technical training of

the employees to cater to multinational companies. Although the labor costs in

China are lesser compared to India, Chinese employees are unlike Indian

employees. Infosys has an extremely high attrition rate in China because the Chinese

believe a 10-12% annual raise is not good enough[10]. Infosys will need to find

alternate ways to engage the Chinese employees and get return on investment for

its training and maintain its profit margin.

4.

Technological

The foreign companies

entering China are looking at established players in the software industry, who

could understand systems, technologies, procedures and standards in China, and

Infosys does not want to miss this high potential business opportunity. The

market for software and IT services in China is expected to grow exponentially

and according to Gartner, Indian IT companies are expected to account for 40%

of this market.

B. Industry

and Competitive Environment

1.

Existing Competitors

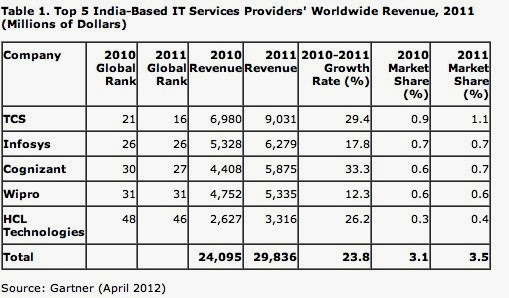

Infosys is competing

globally with other Indian IT companies such as TCS, Wipro, HCL Technologies,

and Cognizant for clients as well as human resources. The 2011 global market

share of its competitors is as presented below.

The most important

reason for entering China was the soaring salaries of software professionals in

India - a result of growing global demand for them[11]. With an increasing number

of international firms such as IBM, Microsoft, Accenture, and Deloitte

competing with Infosys for hiring from the same pool of software engineering

professionals, the gap between the demand and availability of skilled manpower

in India was likely to increase further, and India was estimated to witness a

shortage of 250,000 workers in the IT industry by 2009, according to a study

conducted by KPMG and NASSCOM. However, Infosys will still face intense

competition in China from domestic software companies as well as foreign

competitors who are also trying to expand Chinese operations, many of whom have

entered China much before Infosys. However, China is undergoing a huge

industrial revolution and is an important emerging market with a strong talent

pool.

2.

Threat of Substitute Products or Services

Infosys provides a

range of proprietary products and support services that can be customized to

suit the business needs of its clients across multiple domains such as banking,

retail and insurance as described earlier. However, similar bespoke products

and services are also provided by its global competitors as well as domestic

competitors in China, so there is a higher threat of substitute products and

services with lower switching costs. Infosys has been known to acquire

long-term project contracts with its clients in US and UK. In China, due to the

highly competitive domestic software services industry that is vying for

foreign clients, Infosys will need to price the projects right in order to gain

long-term contracts[12].

3.

Bargaining Power of Buyers

Due to the presence

of a large number of domestic and international IT companies in China the

bargaining power of its customers has increased. Also multinational companies

may prefer to switch to domestic IT and consulting companies to leverage the

local knowledge.

4.

Bargaining Power of Suppliers

Infosys has to

compete for skilled-labor with the global and domestic IT companies in China as

well, which increases the bargaining power of its suppliers, who are mainly

software and IT engineers. Software companies are known to poach employees by

providing a “joining bonus”. This may eventually drive up wage levels, just

like in India, making it more difficult to attract and retain employees.

5.

Barriers to Entry

The Chinese

government regulations present significant barriers to entry to international

IT companies. However, there are relatively lower barriers to entry to domestic

IT companies, except in terms of technological infrastructure requirements.

IV.

Internal Environment (Strengths and Weaknesses):

A. Mission

Infosys’s Vision and Mission are important drivers

of its strategic decisions. The vision statement “We will be a globally

respected corporation” reflects its intent for going global and expanding

globally. The mission statement “Strategic Partnerships for Building Tomorrow’s

Enterprise” reflects a desire to acquire or partner with the right company with

complementary expertise. Infosys Chief Executive Officer and Managing

Director S. D. Shibulal articulates his vision of the smart

enterprise by focusing on “emerging economies” as one of the key drivers of

business. In light of these views, the decision to expand into China clearly

supports Infosys’s mission of becoming a global enterprise.

B. Financial

Position

Reviewing the financial statements of Infosys at the

time it entered China, Infosys' global revenues increased by 33.5% from

Rs 71.3 billion in the financial year 2004-05 to Rs 95.2 billion in the

financial year 2005-06. However, its Chinese subsidiary had incurred loss of Rs

166 million on revenue of Rs 260 million. The reason for this loss, Infosys

said, was that though it was able to secure some local clients, it was unable

to attract foreign companies operating in China to procure its services[13]. By

altering its premium pricing strategy and leveraging its competitive advantage

with existing multinational clients in China, Infosys has been able to gain a

sturdy financial position in China and has been listed as the Top 10 global

service providers in China by the China council for International Investment

Promotion[14].

Infosys is in a strong financial position with

revenue of more than $6 billion in 2011. Infosys has been consistently enjoying

not only financial success but also a very high price-equity ratio that gives

it an excellent valuation on the stock markets and a blue chip status. This

implies that it has the capital to expand, and also the basis to leverage

potential investors. Infosys hopes that its Chinese operations would contribute

10% of its total revenues by 2015[15].

C. Sources

of Competitive Advantage

Infosys has a

strong brand recognition in the IT industry in India and abroad. It was the

first Indian company to list on a US Stock Exchange. It is ranked among the 50

most respected countries in the world by Reputation Institute’s Global Pulse

2009. It has also been voted most admired Indian company in the Wall Street

Journal Asia since 2000. The strong brand identity would definitely help

Infosys in attracting employees as well as new clients in China. Many of

Infosys’s existing clients have moved into China, and they might prefer to

continue their strategic IT alliance with Infosys to leverage existing

knowledge and keep learnings within the company. Having Infosys located in

China, will give the proximity advantage for customer service that Infosys

maintains with its on-site client locations.

Infosys China

office has been operational since eight years and has served as an additional

base for global customers. The time zone difference between the western

countries and China will help Infosys leverage its Global Delivery Model

effectively. The low labor-cost advantage will also help Infosys in maintaining

its profit margins and differentiation strategy while providing value-creation

products and services to its clients.

Infosys has a comprehensive

portfolio of solutions as well as IT quality standard certifications such as

CMM Level 5i and Six Sigma expertise to differentiate from domestic competitors

in China. Infosys also has excellent infrastructure, telecommunication

facilities and the capability of global 24/7 delivery through its development

centers in other locations, which gives it a competitive advantage over the

domestic competitors.

Infosys has been

awarded the No. 1 spot globally for its corporate governance practices and No.

2 spot for its financial disclosures policies by IR Global Rankings (IRGR).

IRGR is the most comprehensive technical ranking system for investor relations

websites, corporate governance practices and financial disclosure procedures[16].

This will definitely provide Infosys a competitive advantage compared to other

IT companies in China, which has a weak legal structure.

Despite being a

huge IT company compared to its Indian competitors such as TCS, HCL, Wipro and

Cognizant, Infosys is much smaller than its global competitors such as IBM, HP

and Accenture. Infosys generated $6 billion in 2011, which is relatively low in

comparison with large global competitors such as Hewlett-Packard ($91 billion),

IBM ($91 billion), EDS ($21 billion) and Accenture ($18 billion)[17].

Also, Infosys’ Chinese office has been operational for only eight years, so it

has relatively less experience in China than some of its other international competitors.

Infosys has also

been struggling with high attrition rates of 14.9% in 2012 due to wage-hike

issues. These attrition numbers are thrice as much as the general industry rate[18].

Infosys will need to revamp its human resource strategy in China to prevent a

high attrition and retain its resource knowledge and capabilities within the organization.

Infosys does not

have experience with acquisitions and has traditionally been averse to acquisitions;

its first acquisition was Lodestone Holding AG in Switzerland in October 2012. There

is a significant learning curve from incorporating another company, especially

when the parent company has a strong corporate culture. As Infosys plans

aggressive expansion in China through acquisitions, it should look to find a

suitable company with a similar corporate culture to avoid any culture clashes

that create disharmony within the organization.

D. Corporate

Governance

In the last ten

years, after founder Narayan Murthy stepped down as CEO, Infosys has had four

CEOs, with each of the co-founders taking a shot at leading the company. This

has affected the company’s growth and critics say that Infosys is overly

focused on service delivery and not enough on sales; that it is slavish to

preserving margins at the expense of winning new business[19]. Infosys’s

new CEO S.D. Shibulal who took over in 2011 is the main driver behind the

strategic shift towards global expansion through acquisitions.

E. Corporate

Culture

Infosys has a

strong corporate culture, where each employee is treated as part of the Infosys

family and referred to as “Infoscion”. It invests in its employees with a

long-term goal and trains them to become global employees, so as to facilitate

easy movement of resources between different development centers and client

locations. It is common for employees to rotate between on-site client

locations and off-shore development centers. Customer-centric focus is a strong

part of the corporate culture and the company urges its employees to work

towards “customer delight” and not simply “customer satisfaction”. Infosys’

approach in China is also with a long-term view of obtaining skilled resources

to join the Infosys “family” and work towards creating a strong skilled labor

base.

F. Code

of Ethics

Infosys is a

highly respected IT company that considers ethics critical to its business

strategy. Although Infosys is targeting China mainly for low-cost labor, it is

focused on delivering long-term value to its employees, shareholders and

society[20]. Many manufacturing companies like Nike are

known to take advantage of the low-cost labor in China through sub-contractors,

which can cause labor law violations and worker exploitation. Infosys is

known to invest heavily in training its employees to support the long-term

goals of the company and not exploiting its employees for short-term gains.

Infosys’ long-term goals in China are evident from the $125-150 million investment in establishing its own campus in

Shanghai versus subcontracting to local IT companies in China.

V.

Global Ethics and Social Responsibility

Considerations

Infosys has been

consistently viewed as the most transparent and ethical organization by the

customers, employees, society and the investor community. Infosys's founder and

Chairman Emeritus, Narayanamurthy, has always been a great follower and

advocate of ethics in business. While a number of organizations today are

engaged in window-dressing their accounts and also are trying to communicate a

performance far better than the actuals, with a view to inflating their

valuation, Infosys always followed the policy of naked transparency in front of

the investing community, through their ' When in doubt, disclose' approach[21]. Infosys

was ranked among 'India's Best Companies to Work For - 2009' in a survey by the

Great Place to Work® Institute India in collaboration with The Economic Times.

Infosys featured among the best companies for large organizations and corporate

social responsibility.

VI.

Final Conclusion and Summary

With the slowing

growth rate in the last ten years in US and Europe due to economic slowdown, a

turbulent corporate leadership at Infosys, growing pressure from the

shareholders, the increasingly competitive skilled-labor situation and soaring

salaries in India and an emerging market in China, I think Infosys’ China

expansion is a need of the hour. However, Infosys will need to keep

[1]

Arakali, H., & Chatterji, S.

(2012, May 7). Infosys woes prompt calls for change at top| Reuters. Business & Financial

News, Breaking US & International News | Reuters.com.

Retrieved December 15, 2012, from http://www.reuters.com/article/2012/05/07/us-india-infosys-idUSBRE84606420120507

[2]

Global information technology market

to grow by 5.88% until 2015: TechNavio - Computer Business Review. (2012, May

15). IT

Services Industry News - Services - Computer Business Review.

Retrieved December 14, 2012, from http://itservices.cbronline.com/news/global-information-technology-market-to-grow-by-588-until-2015-technavio-150512

[3]

Infosys Products and Platforms.

(n.d.). Infosys - Business Technology Consulting | IT

Services | Enterprise Solutions. Retrieved December 14,

2012, from http://www.infosys.com/products-and-platforms/Pages/platforms.aspx#platforms s

[4]

Supplier profile: Infosys. (n.d.). ComputerWeekly.com.

Retrieved December 14, 2012, from http://www.computerweekly.com/guides/Supplier-profile-Infosys

[5]

Infosys - About the Company. (n.d.). Infosys - Business Technology

Consulting | IT Services | Enterprise Solutions.

Retrieved November 13, 2012, from

http://www.infosys.com/about/Pages/index.aspx

[6]

Is it time Infosys cut prices?

(2012, September 10). Business Standard.

Retrieved December 14, 2012, from http://www.business-standard.com/india/news/is-it-time-infosys-cut-prices/485837/

[7]

Mishra, B. R. (2011, December 28).

Infosys BPO to expand in China. Business Standard.

Retrieved November 12, 2012, from http://www.business-standard.com/india/news/infosys-bpo-to-expand-in-china/459980/

[8]

Hector, D. J. (2012, March 13).

Infosys to hike China head count, retain best workers.Financialexpress.com.

Retrieved January 4, 2012, from http://www.financialexpress.com/news/infosys-to-hike-china-head-count-retain-best-workers/923032/

[9]

Infosys in China. (2006). IBS Center for Management

Research. Retrieved December 14, 2012, from http://www.icmrindia.org/casestudies/catalogue/Business%20Strategy/Infosys%20in%20China.htm

[10]

Hector, D. J. (2012, March 13).

Infosys to hike China head count, retain best workers.Financialexpress.com.

Retrieved January 4, 2012, from http://www.financialexpress.com/news/infosys-to-hike-china-head-count-retain-best-workers/923032/

[11]

Infosys in China. (2006). IBS Center for Management

Research. Retrieved December 14, 2012, from http://www.icmrindia.org/casestudies/catalogue/Business%20Strategy/Infosys%20in%20China.htm

[12]

Fung, E. (2011, September 15).

Infosys China CEO: Will Continue to Expand Organically - WSJ.com. The Wall Street Journal.

Retrieved December 14, 2012, from http://online.wsj.com/article/SB10001424053111904060604576572211692441924.html

[13]

Infosys in China. (2006). IBS Center for Management

Research. Retrieved December 14, 2012, from http://www.icmrindia.org/casestudies/catalogue/Business%20Strategy/Infosys%20in%20China.htm

[14]

Infosys ranked among the Top 10

Global service providers in China. (2012, July 13). Infosys Press Release.

Retrieved December 15, 2012, from http://www.infosys.com/newsroom/press-releases/Documents/2012/global-service-providers-award.pdf

[15]

Infosys in China. (2006). IBS Center for Management

Research. Retrieved December 14, 2012, from http://www.icmrindia.org/casestudies/catalogue/Business%20Strategy/Infosys%20in%20China.htm

[16]

Infosys - Corporate Governance

Practices | IR Global Rankings. (n.d.). Infosys.

Retrieved December 15, 2012, from http://www.infosys.com/newsroom/press-releases/Pages/corporate-governance-practices.aspx

[17]

Infosys SWOT. (n.d.). Marketing Teacher.

Retrieved December 14, 2012, from http://www.marketingteacher.com/swot/infosys-swot.html

[18]

Iyer, S. (2012, July 16). Infosys

attrition number is the real shocker | Firstpost. Latest News: Breaking/Live

News Today, Latest News India, Politics News, Business/Stock Market News,

Sports Updates, Bollywood News and Opinions - Firstpost.com.

Retrieved December 14, 2012, from http://www.firstpost.com/business/infosys-attrition-number-is-the-real-shocker-378976.html

[19]

Fung, E. (2011, September 15).

Infosys China CEO: Will Continue to Expand Organically - WSJ.com. The Wall Street Journal.

Retrieved December 14, 2012, from http://online.wsj.com/article/SB10001424053111904060604576572211692441924.html

[20]

Code of Conduct. (n.d.). Infosys.

Retrieved December 15, 2012, from http://www.infosys.com/investors/corporate-governance/Documents/CodeofConduct.pdf

[21]

Srinivas (2012, July 30). Secrets of

Successful Organizations..: BENCHMARK FOR BUSINESS ETHICS- INFOSYS & &

TATA GROUP. Secrets of Successful Organizations..

Retrieved December 15, 2012, from http://mastermentorsadvisory.blogspot.com/2012/07/benchmark-for-business-ethics-infosys.html

Subscribe to:

Posts (Atom)